Queenstown Condo Analysis: Why This City-Fringe Estate Still Leads in Value and Demand

Queenstown Condo Analysis – Queenstown holds a special place in Singapore’s housing story. Developed in the 1950s as the nation’s first satellite town, it has evolved from a quiet residential area into one of Singapore’s most desirable city-fringe estates. Strategically located between the Central Business District (CBD) and the Greater one-north innovation corridor, Queenstown continues to draw attention from investors and homebuyers alike.

In this article, we explore why Queenstown remains one of Singapore’s top-performing property markets—covering its location advantages, amenities, price trends, and investment potential.

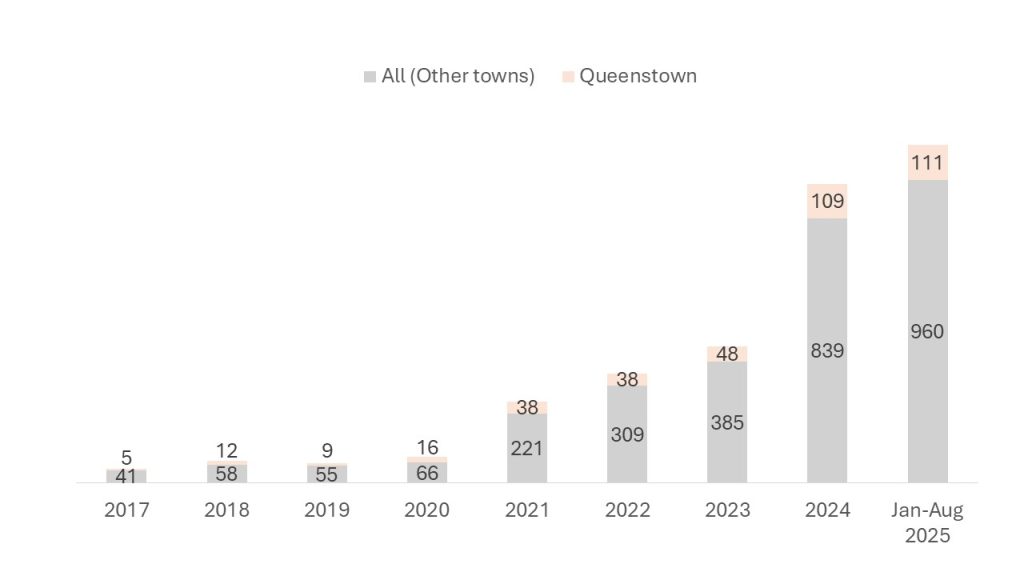

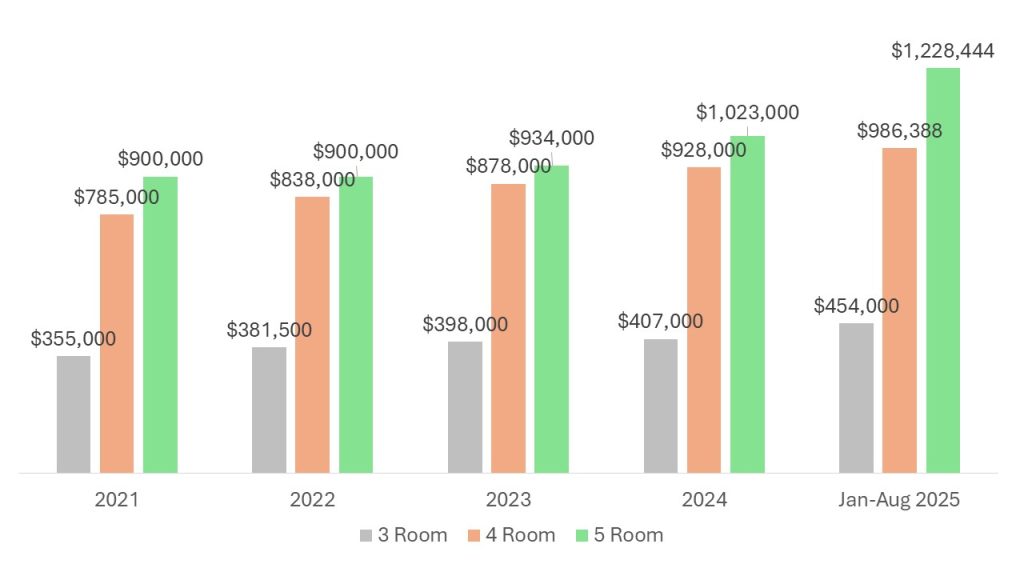

Source: data.gov.sg as of 8 Sep 2025, ERA Research and Market Intelligence

1. A Prime City-Fringe Location with Long-Term Growth Potential

Positioned in the Central Region and bordered by prestigious districts such as Bukit Timah, Tanglin, and Holland, Queenstown offers city convenience without downtown congestion. Its proximity to Orchard Road, Holland Village, Dempsey Hill, and the one-north business hub places it firmly within Singapore’s growth belt.

The URA 2025 Draft Master Plan highlights ongoing rejuvenation in nearby Dover-Medway—part of the Greater one-north cluster. This high-tech employment node will boost housing demand in adjacent estates, particularly Queenstown, due to its strategic midpoint between the CBD and the innovation corridor.

For investors, this signals steady rental demand from professionals working in one-north, Buona Vista, and Alexandra. For owner-occupiers, it translates to convenient accessibility and strong lifestyle value.

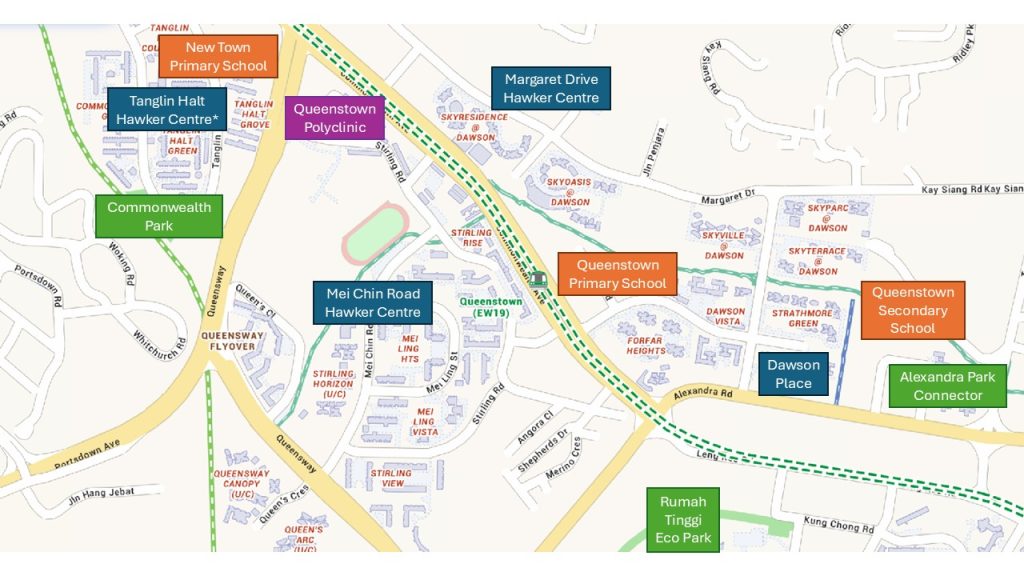

Source: Wikipedia, ERA Research and Market Intelligence

2. Abundant Amenities and New Infrastructure Enhancements

As Singapore’s first self-sufficient housing town, Queenstown continues to deliver exceptional convenience. Residents enjoy easy access to:

Retail & Food: Queensway Shopping Centre, IKEA Alexandra, Anchorpoint, Alexandra Village, and an emerging café scene.

Healthcare: Queenstown Polyclinic and nearby Alexandra Hospital.

Greenery: Alexandra Canal Linear Park, Rail Corridor, and new planned green spaces under URA’s enhancement plan.

Education: Proximity to schools such as Fairfield Methodist, Anglo-Chinese School (Independent), and Singapore Polytechnic.

New developments like the Tanglin Halt integrated hub—with shops, a market, hawker centre, and a new polyclinic—will anchor the estate’s next phase of renewal. The upcoming refurbished Queenstown Sports Centre (expected end-2025) will also reinforce its liveability.

These amenities ensure residents’ daily needs are met within the estate, strengthening its position as a complete, family-friendly environment.

Source: Onemap, ERA Research and Market Intelligence

3. Evergreen Demand in a Mature Estate

Queenstown’s combination of strong connectivity, rich amenities, and central location fuels its consistent price resilience.

Since 2021, HDB resale prices in Queenstown have risen sharply:

3-room: +26.5%

4-room: +25.8%

5-room: +33.3%

As of August 2025, Queenstown has recorded over 388 million-dollar flats since 2017, including Singapore’s highest transacted HDB resale flat — $1.66 million for a 5-room unit at Dawson Road.

The strong performance reflects buyers’ willingness to pay a premium for a limited-supply, city-fringe location with enduring appeal.

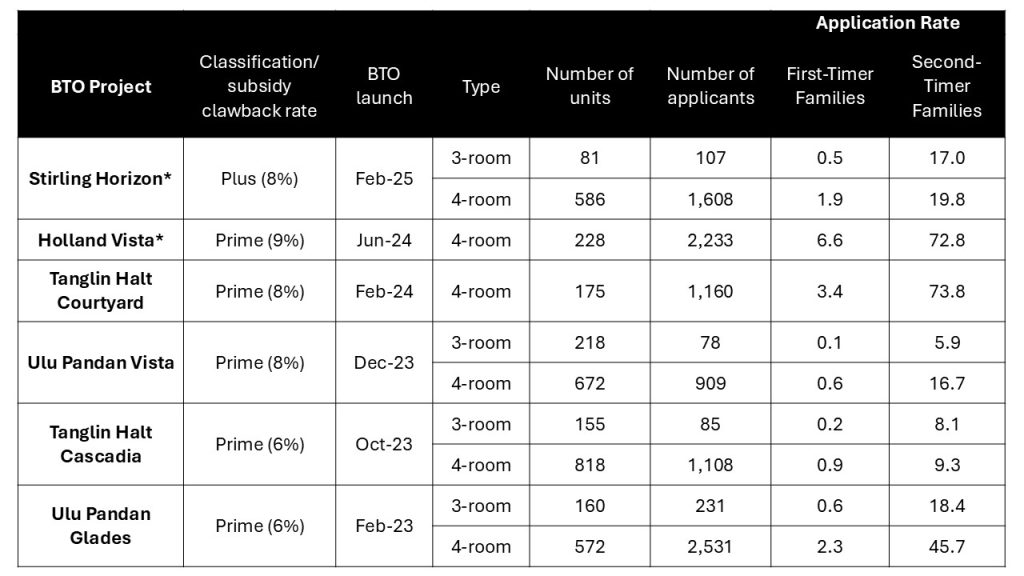

Even with the introduction of Prime and Plus flat classifications, which impose stricter resale rules, demand remains robust—underscoring long-term confidence in Queenstown’s fundamentals.

Source: data.gov.sg as of 10 Sep 2025, ERA Research and Market Residences

4. Limited Private Condo Supply Creates Pent-Up Demand

Queenstown has not seen a new private condominium launch in seven years. The last two—Margaret Ville and Stirling Residences, both launched in 2018—achieved impressive take-up rates of over 50% in their first year despite cooling measures.

The absence of new launches since then has tightened supply and likely contributed to premium pricing in the resale market. Buyers seeking proximity to the city but deterred by Core Central Region (CCR) prices often find Queenstown an ideal balance of value and accessibility.

The upcoming Penrith (Margaret Drive GLS) development — comprising 462 units—is expected to attract strong interest as the first new Queenstown condo launch in years. With limited future land parcels available, scarcity will continue to support price stability and long-term capital appreciation.

Source: HDB, ERA Research and Market Intelligence

5. Investment Outlook: Strong Fundamentals, Scarce Supply

Queenstown’s unique combination of heritage, location, and urban renewal makes it an enduring favourite for investors. The area benefits from:

High rental demand from professionals in nearby one-north and CBD.

Limited new supply due to land scarcity.

Continuous rejuvenation through URA’s Master Plan.

Proven capital appreciation across both public and private segments.

For investors, this means an opportunity to enter a low-risk, high-demand market with long-term upside. For homeowners, it offers a blend of convenience, prestige, and future growth potential.

Conclusion

From its roots as Singapore’s first satellite town to its current status as a city-fringe powerhouse, Queenstown continues to outperform expectations. With its mix of connectivity, rich amenities, and strong price fundamentals, it remains one of the most compelling property investment locations in Singapore.

As the next wave of redevelopment unfolds—especially around Dover-Medway and Tanglin Halt—Queenstown’s story is far from over. For investors and homebuyers eyeing city-fringe opportunities, this mature estate offers a timeless blend of heritage, growth, and value.

Blogs

We think that these articles might be of interest to you or perhaps you might be interested with our latest Singapore Upcoming New Launches list?