Beyond ABSD: The Path to Long-Term Residence for Foreigners and Broader Policy Goals

Disclaimer: This article will examine skilled foreigners who are not classified as High Net-Worth Individuals (HNWIs) and are not covered by the benefits of the free trade agreements (FTAs) established with Singapore.

Attracting skilled foreign professionals has long been a strategic policy adopted by the Singapore government in response to demographic challenges, including a rapidly ageing population and low birth rates. However, with the current high ABSD environment for foreigners, this raises questions about whether the increased foreigner ABSD discourages foreigners from coming to Singapore to settle and contribute to the economy.

Demographic challenges faced in Singapore

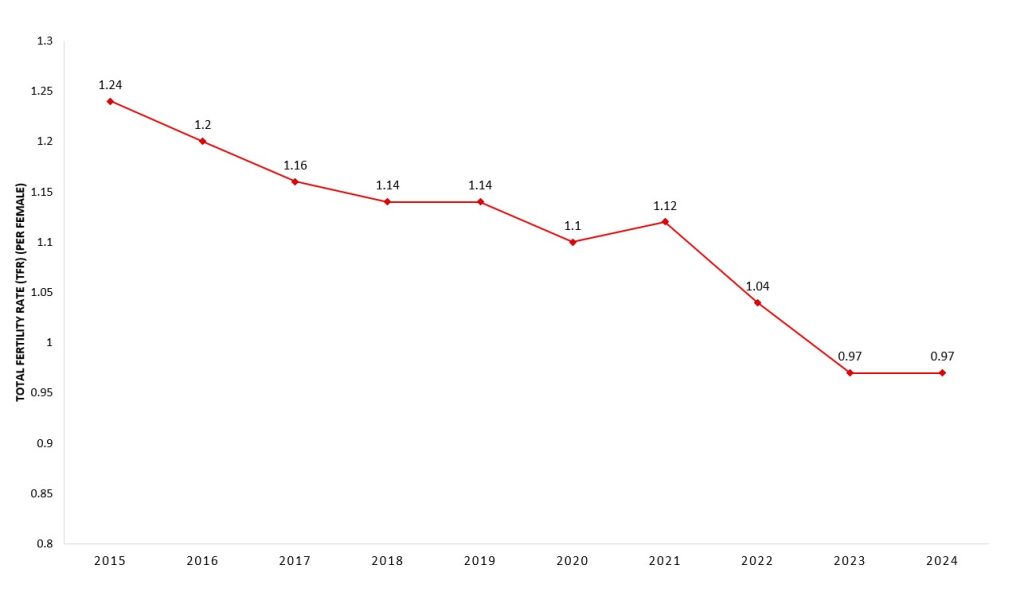

Singapore has been experiencing a decline in birth rates. As of 2024, Singapore’s resident total fertility rate remains at a historic low of 0.97 births per woman since 2023, with an average decline rate of approximately 4.28% year on year. Even the culturally significant “Dragon Year” in 2024, which is traditionally associated with birth spikes, failed to boost Singapore’s fertility, reflecting shifting priorities and goals among young couples.

Chart 1: Birth rate in Singapore (2015-2024)

Source: singstat.gov.sg

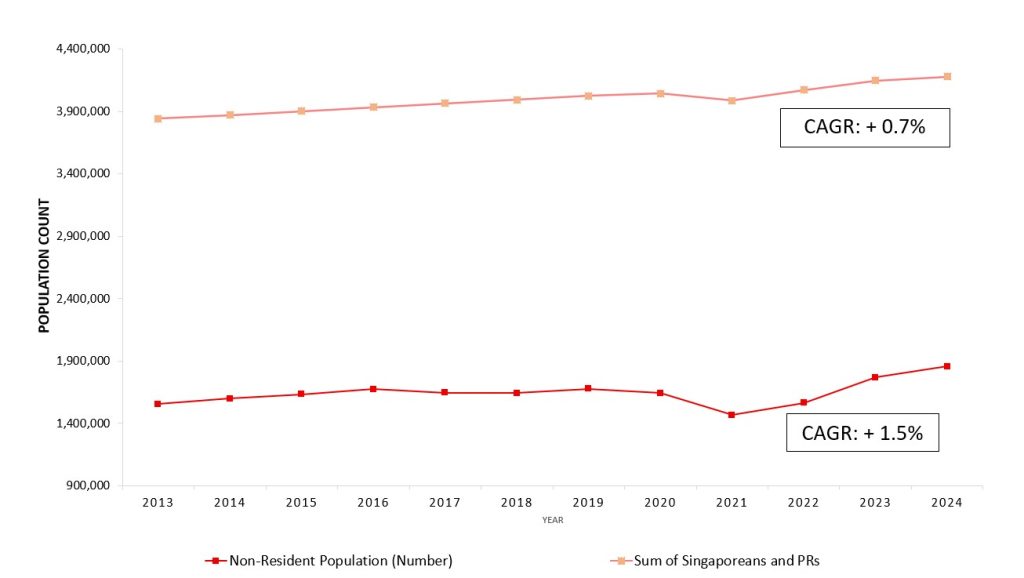

As highlighted in the Population White Paper 2013, Singapore’s total population is expected to reach between 6.5 and 6.9 million by 2030. However, growth rates for Singaporeans and Permanent Residents have been sluggish, with a compound annual growth rate (CAGR) of +0.7%. This contrasts with a higher growth rate for non-residents, at a CAGR of +1.5%.

The current population of Singapore is 6 million, with a total of 30,808 resident live births as of 2024. Assuming the birth rate remains constant, it will be very difficult to reach the target of 6.5 million by 2030 without either significantly increasing the local birth rate or attracting more foreign nationals. This shows that foreigners continue to play a vital role in supporting the overall population and helping to achieve a higher population goal.

As such, we observed the Singapore government implementing a two-pronged approach: encouraging locals to have children through incentives like the Baby Bonus Scheme, and attracting foreigners to Singapore to establish businesses, such as the Overseas Networks & Expertise Pass (ONE Pass) introduced in Jan 2023.

Chart 2: Population growth of Singapore (2013- 2024)

Source: singstat.gov.sg

Attracting foreign skilled workers to migrate to Singapore, settle, and contribute to the economy has therefore been a key message echoed by the Singapore government, compelling Singapore to remain open to global talent to sustain its economic resilience and international standing.

How does ABSD impact decision-making for foreigners who want to purchase property in Singapore

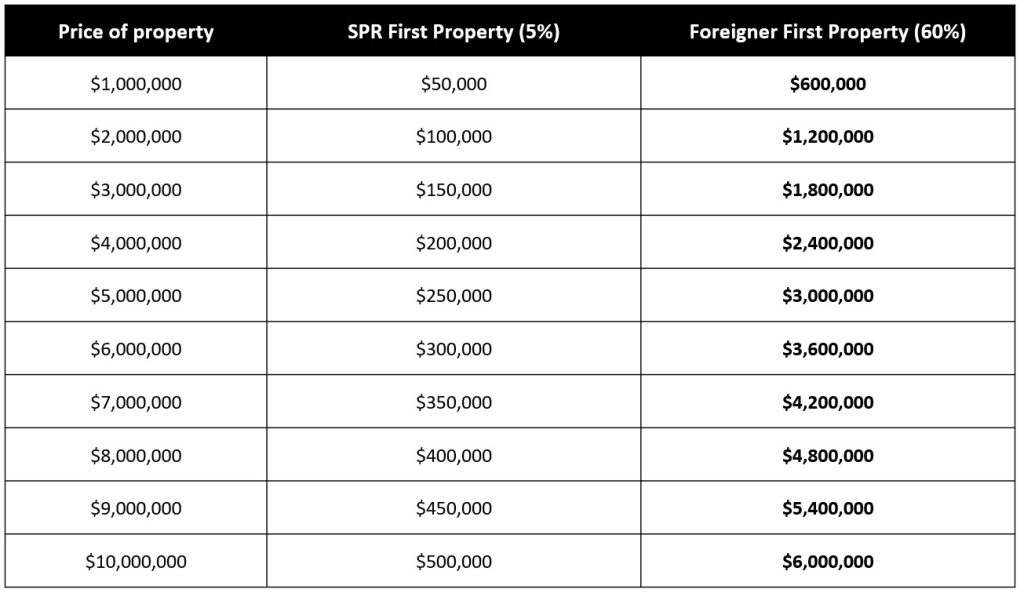

While the high ABSD rates do prevent speculative demand, they also impact foreigners who plan to purchase private property for long-term residence. The 60% ABSD rate on a first property for foreigners results in a significant cost difference compared to SPRs, who only pay 5%. Consequently, there is a financial disincentive for foreigners to establish their roots here through property ownership.

Table 1: Calculation of ABSD when purchasing first property

Source: ERA Research & Market Intelligence

Therefore, the most practical way for foreigners to buy property for personal residence is to initially rent then apply for PR status to minimise the ABSD tax burden. However, this approach may not be sustainable in the long term.

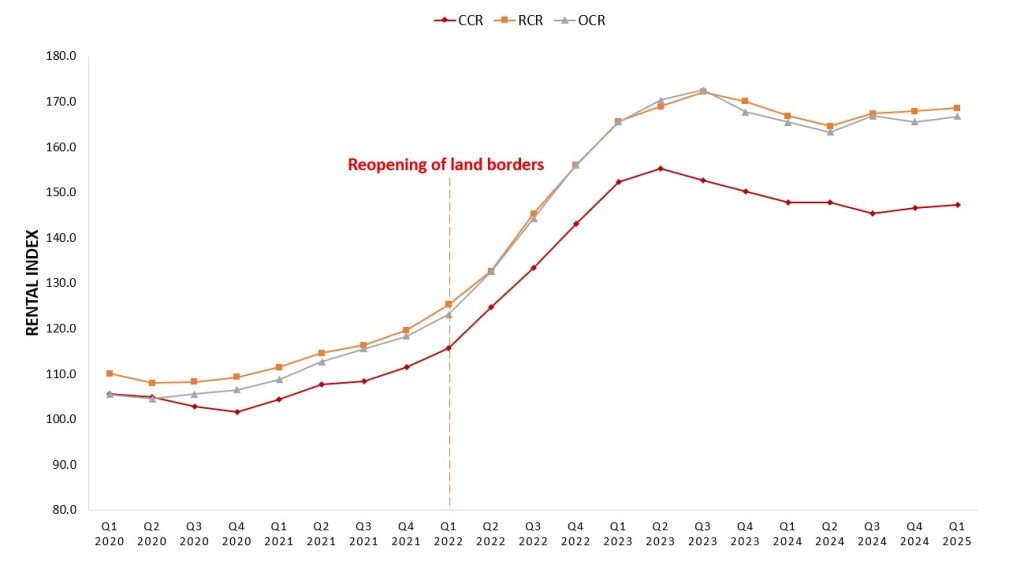

Looking at the Rental Price Index (RPI), rents have surged since the end of COVID, likely due to the reopening of borders and an influx of new foreigners. The sustained high level indicates strong rental demand, with the index remaining consistently above 160 for OCR and RCR segments since its peak in 1H 2023.

Chart 3: Rental Price Index Across Market Segments (1Q 2020 – 1Q 2025)

Source: URA REALIS, ERA Research & Market Intelligence

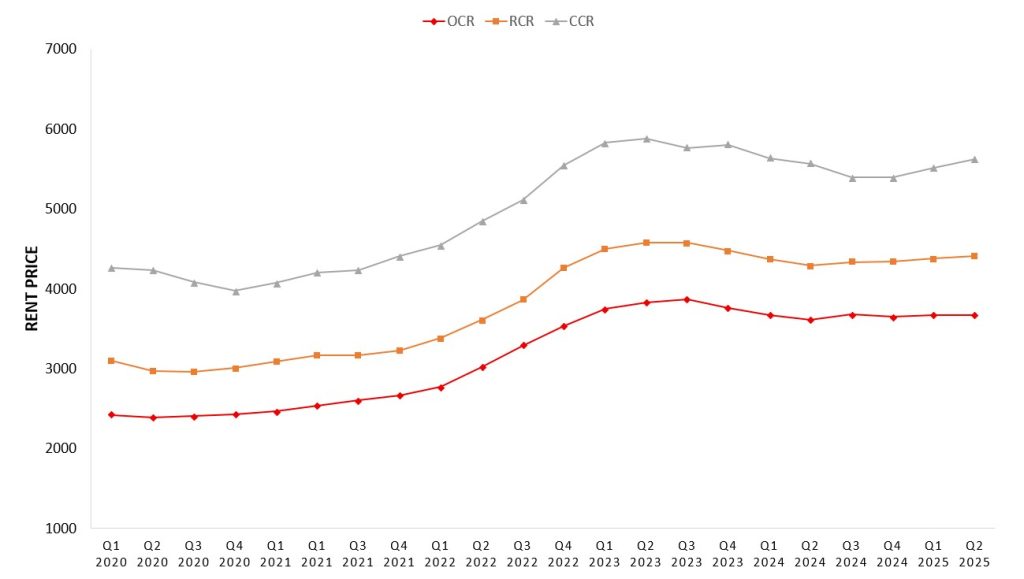

Moreover, rents are increasingly taking up a significant portion of monthly income, especially for foreigners holding Employment Passes and S-Passes. Based on average monthly rental data for a typical 2-bedroom private unit, foreigners on S-Passes will face rental costs that exceed their current qualifying salary of $3,150. For foreigners on an Employment Pass, the average rent for CCR units accounts for approximately 90% of their minimum monthly qualifying wage of $5,500, whereas renting units in the RCR and OCR will take up approximately 56% to 70% of their monthly income.

Such figures thus highlight the financial strain faced by middle-tier foreign professionals in securing affordable rents while waiting for their PR approvals.

Chart 4: 5-Year Average Monthly Rent For a 2-Bedroom Private Non-Landed Property (2020-2025)

Source: URA REALIS, ERA Research & Market Intelligence

HDB rental rates to remain strong

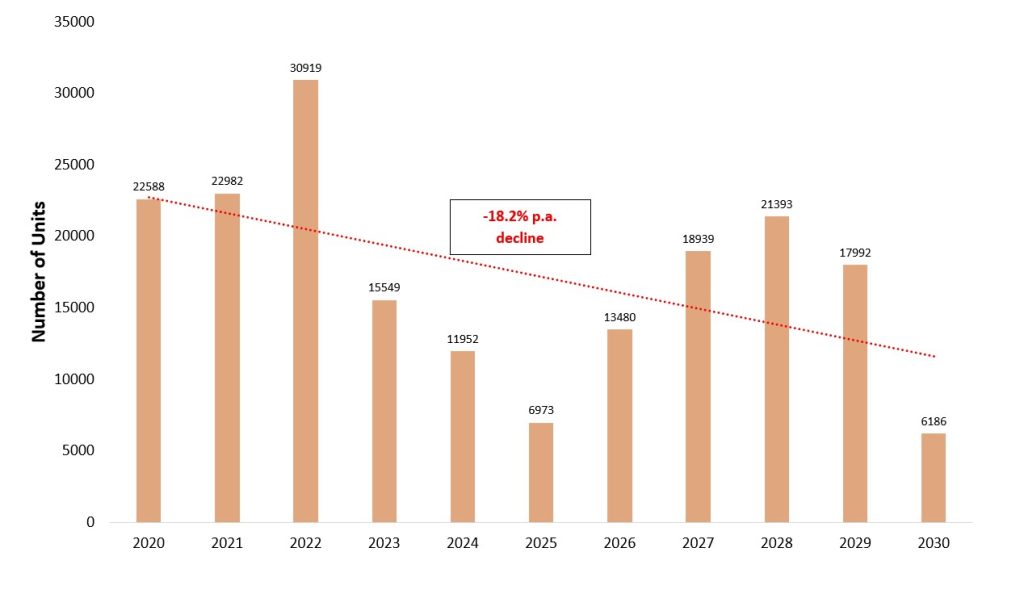

Alternatives such as renting HDB flats, while an affordable option for foreigners, are likely to see more rental price increases as the number of MOP flats continues to tighten at an average rate of 18,2% decline per year, decreasing the number of flats entering the rental market. Considering possible competition from local renters and price-sensitive tenants amidst the current economic uncertainty, demand for HDB rentals might rise and persist, applying more upward pressure on rental prices. However, not all flats reaching their Minimum Occupation Period translate into rental stock; a significant proportion remains owner-occupied, which caps the HDB rental supply.

Chart 5: Number of HDB flats reaching the 5-Year MOP period

Source: data.gov.sg, ERA Research & Market Intelligence

Amidst supply-side constraints, foreigners who opt for the rent-and-wait approach will face higher costs and might not prove to be a suitable long-term solution for owning a property in Singapore. This adds to the already lengthy and stringent process of obtaining a SPR, which involves multiple criteria and considerable uncertainty.

Is it time to rethink ABSD for Foreigners Who Intend to Stay Long Term

To better align housing policy with Singapore’s broader population and foreign talent objectives, adjustments can be considered to the current ABSD policy for foreigners while maintaining its deterrent effect on speculative demand.

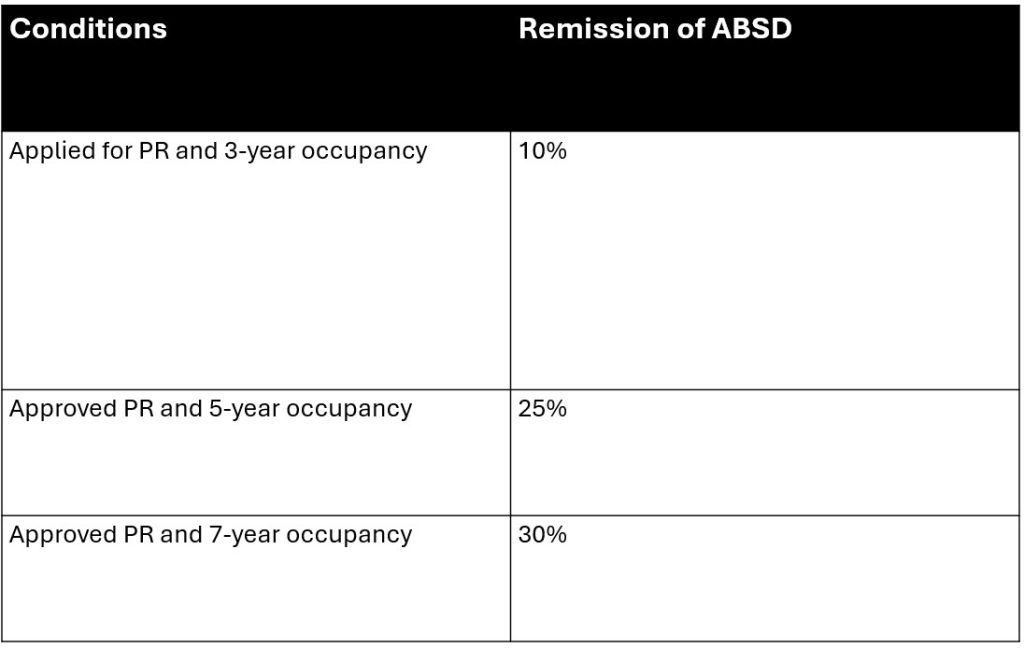

One potential policy recommendation is a tiered ABSD remission scheme for foreigners who demonstrate genuine intent to reside long-term, rather than purchase for investment purposes. Conditions such as obtaining PR status and meeting minimum occupancy targets can be considered to further encourage foreigners for long-term stay.

Table 2: Example of a tiered ABSD Remission Scheme (up to 30%)

Conclusion

As Singapore navigates demographic shifts and global competition for foreign talent, its housing policy must also adapt accordingly. Looking beyond the use of ABSD as a deterrent, a targeted and effective ABSD policy for foreigners could remove key obstacles in Singapore’s population strategy.

On that note, in part 3 of our article series, we will expand this discussion by examining the Core Central Region (CCR). This market is the most vulnerable to foreign buyer trends and is therefore crucial to analyse what is needed to sustain long-term market resilience despite the high ABSD environment.

Blogs

We think that these articles might be of interest to you or perhaps you might be interested with our latest Singapore Upcoming New Launches list?