99-to-1 Shareholding: Smart Move or ABSD Loophole Gone Wrong?

If you’ve been following property news lately, you’d confirm—this “99-to-1 loophole” thing has been everywhere. Headlines like “IRAS to claw back S$60 million from buyers who used 99-to-1 loophole” sure caught a lot of eyeballs.

So what’s the big deal? Is 99-to-1 shareholding illegal? Or is it just another creative hack to siam (avoid) ABSD? Let’s break it down simply.

What’s this 99-to-1 arrangement all about?

In Singapore, when two people co-own a property, there are two main ways to do it:

1) Joint Tenancy – both own equally, 50-50, no separate shares. Common for couples or family.

2) Tenancy-in-Common – each person owns a specific share. Could be 50:50, 70:30, or even 99:1.

So technically, 99-to-1 is not illegal. It’s just another way of splitting ownership. One person holds 99%, the other 1%. Simple.

Then why is IRAS cracking down?

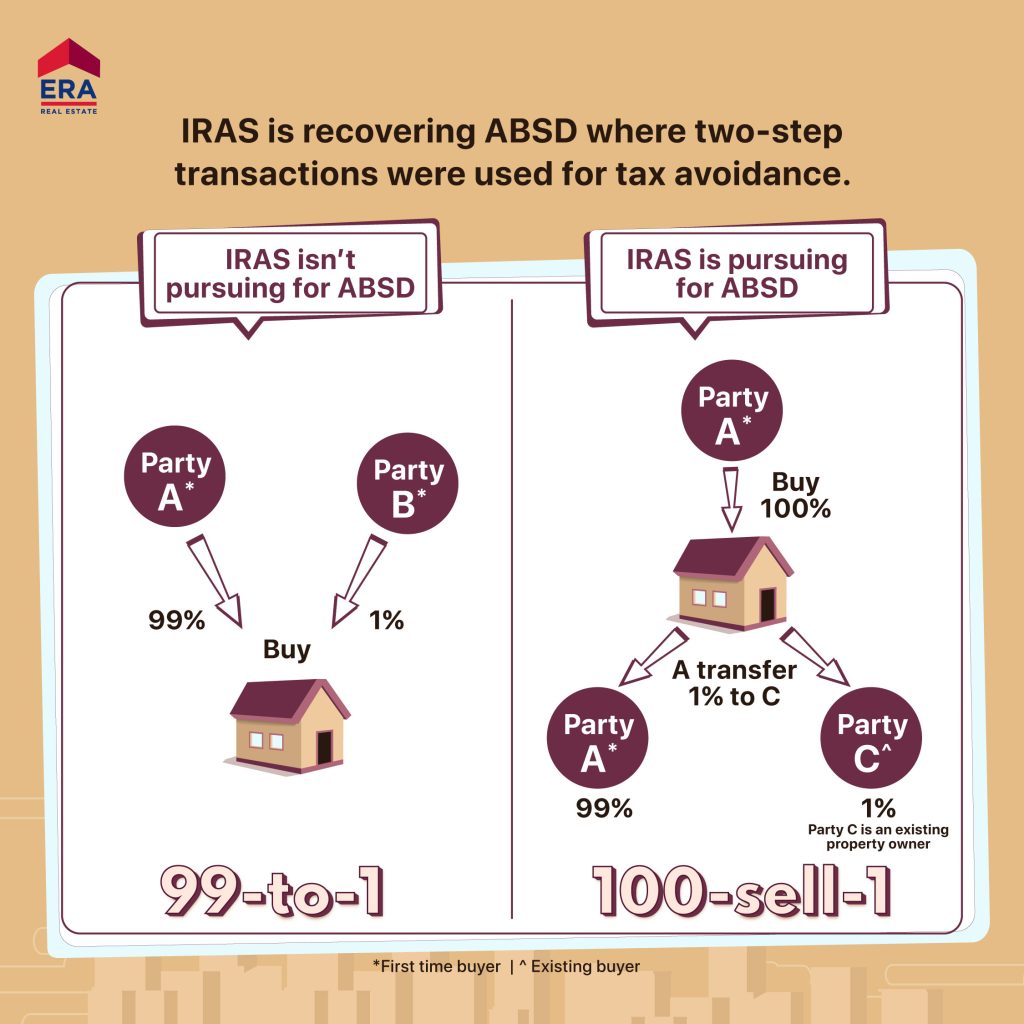

Here’s where things get tricky. The cases IRAS is after are those so-called “two-step” transactions.

How it works:

Party A (who doesn’t own any property yet) buys the whole house under their name.

Shortly after, they transfer 1% to Party B (who already owns another property).

Why do this? Because if Party B bought together with A from the start, they’d need to pay ABSD on the entire property. But by doing this trick, Party B only pays ABSD on that tiny 1%. That’s what IRAS calls tax avoidance.

And now, they’re clawing back millions and slapping a 50% surcharge on the ABSD amount. Ouch.

Are there legit reasons to use 99-to-1?

Yes, of course. Not everyone is trying to game the system. Some valid uses include:

Fairness: If one person puts in more money, then it’s fair they hold a bigger share.

Bigger loan eligibility: With two names, banks assess combined income, so easier to get a bigger loan.

Future planning (decoupling): Couples may plan ahead. With a 99:1 split, later the 1% owner can transfer their share, “freeing” themselves to buy another property without ABSD (since they technically don’t own any property after that).

That’s different from the “100-sell-1” loophole, because here, both parties were co-owners right from the start.

So what now for buyers?

Bottom line—don’t play play with these “shortcuts.” IRAS has made it very clear: if you try funny business just to avoid ABSD, you’ll kena clawback plus penalty.

If you’re thinking of doing any 99-to-1 structure, make sure you talk to a proper tax advisor or lawyer. Otherwise, what looks like a clever trick now could end up costing way more later.

👉 What do you think? Is 99-to-1 still worth considering, or better to stay away given the recent crackdown?

Blogs

We think that these articles might be of interest to you or perhaps you might be interested with our latest Singapore Upcoming New Launches list?