Measures to Cool Singapore Property Market 2021

Singapore Government announced today a package of measures to cool the private residential and HDB resale markets. With effect from 16 December 2021, Additional Buyer’s Stamp Duty (ABSD) rates will be raised, and the Total Debt Servicing Ratio (TDSR) threshold will be tightened. The Government will also tighten the LTV limit for loans from HDB from 90% to 85%. In addition, the Government will increase public and private housing supply to cater to demand.

The Government has been closely monitoring the property market for several quarters. The private residential and HDB resale markets have been buoyant, despite the economic impact of COVID-19. Private housing prices have risen by about 9% since 1Q2020. HDB resale flat prices are also recovering sharply after a six-year decline,1 rising about 15% since 1Q 2020. Even though House Price-to-Income ratios remain below their historical averages, there is clear upward momentum. Amid the low interest rate environment, transaction volumes in the private housing market and HDB resale market have also been high despite the COVID-19 situation.

If left unchecked, prices could run ahead of economic fundamentals, and raise the risk of a destabilising correction later on. Borrowers would also be vulnerable to a possible rise in interest rates in the coming years.

1 The HDB Resale Price Index declined by 9.9% over 5 years between 2014-2018 and remained flat in 2019.

The Government has therefore decided to implement a set of measures to cool the private and public housing markets, to promote continued housing affordability. The private residential measures are calibrated to dampen broad-based demand, especially from those purchasing property for investment rather than owner-occupation. Measures to tighten financing conditions for both public and private housing will encourage greater financial prudence. The Government will also be ramping up the supply for both private and public housing.

Measures Applicable to All Residential Property

Raising Additional Buyer’s Stamp Duty (ABSD) Rates

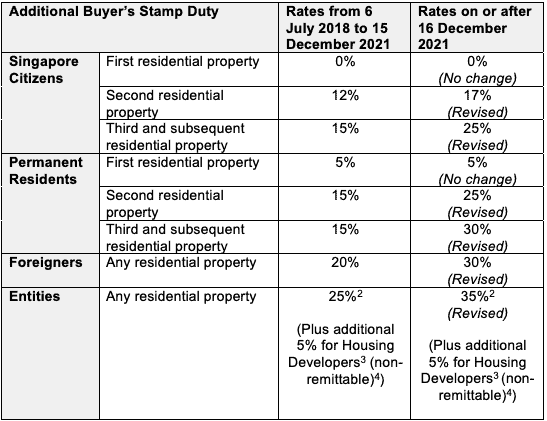

The current ABSD rates for Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs) purchasing their first residential property will remain at 0% and 5% respectively.

The Government will raise the ABSD rates as follows:

a. Raise ABSD rate to 17% for SCs purchasing their 2nd residential property;

b. Raise ABSD rate to 25% for SCs purchasing their 3rd and subsequent residential property, and SPRs purchasing their 2nd residential property

c. Raise ABSD rate to 30% for SPRs purchasing their 3rd and subsequent residential property and foreigners purchasing any residential property,

d. Raise ABSD rate to 35% for entities purchasing any residential property; and

e. Raise ABSD rate to 35% for developers purchasing any residential property. This 35% may be remitted under the Stamp Duties (Non-licensed Housing Developers) (Remission for ABSD) Rules and the Stamp Duties (Housing Developers) (Remission of ABSD) Rules, subject to conditions. In addition to this 35% ABSD rate, the non-remittable component remains unchanged at 5%.

Table 1 summarises the adjustments to the ABSD rates.

Table 1: Adjustments to ABSD Rates for Residential Property

2 As entities, Housing Developers will also be subject to the ABSD rate for entities. Housing Developers may apply for remission of this ABSD, subject to conditions.

3 Housing Developers refer to entities in the business of housing development (i.e. construction and sale of housing units) with respect to the subject property acquired.

4 This 5% ABSD for Housing Developers is in addition to the ABSD for all entities. This 5% will not be remitted, and is to be paid upfront upon purchase of residential property.

For purchases made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply.

Married couples with at least one SC spouse, who jointly purchase a second residential property, can continue to apply for a refund of ABSD, subject to conditions. These conditions include selling their first residential property within 6 months after (a) the date of purchase of the second residential property if this is a completed property, or (b) the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier, if the second property is not completed at the time of purchase.

The ABSD currently does not affect those buying an HDB flat or EC unit from property developers with an upfront remission, if any of the joint acquirers/purchasers is a SC. There will be no change to this.

The revised ABSD rates will apply to cases where the Option to Purchase (OTP) is granted on or after 16 December 2021. There will be a transitional provision where ABSD rates before 16 December 2021 will apply for cases that meet all of the following conditions:

a. The OTP is granted by sellers to potential buyers on or before 15 December 2021;

b. This OTP is exercised on or before 5 January 2022, or within the OTP validity period, whichever is earlier; and

c. This OTP has not been varied on or after 16 December 2021.

Correspondingly, the Additional Conveyance Duties for buyers of equity interest property-holding entities5 will be raised from up to 34% to up to 44% (increase by 10%-points).

5 A property-holding entity is an entity which has at least 50% (i.e. asset ratio) of its total tangible assets comprising prescribed immovable properties in Singapore. Refer to IRAS’ website for details on prescribed immovable properties.

Tightening of Total Debt Servicing Ratio Threshold (TDSR)

The TDSR threshold6 will be tightened by 5%-points from 60% to 55%. The revised TDSR threshold will apply to loans for the purchase of properties where the OTP is granted on or after 16 December 2021, and for mortgage equity withdrawal loan applications made on or after 16 December 2021. Borrowers with existing property loans granted before 16 December 2021 will not be affected by the revised TDSR threshold when refinancing their loans.7

6 TDSR is applicable to both residential and non-residential property loans granted by financial institutions to individuals, sole proprietors and vehicles with no substantive genuine commercial business, set up for the purchase of properties held by individuals.

7 TDSR is currently waived for borrowers who refinance their owner-occupied housing loans. For borrowers refinancing their existing investment property loans, MAS has provided for a temporary TDSR waiver for borrowers affected by COVID-19. Otherwise, the previous 60% TDSR will apply.

Measure Specific to Public Housing

Tightening of Loan-to-Value (LTV) Limit

The LTV limit for HDB housing loans will be tightened by 5%-points from 90% to 85%. The revised LTV limit does not apply to loans granted by financial institutions, for which the LTV limit remains at 75%.

The LTV limit of 85% will apply to new flat applications for sales exercises launched after 16 December 2021, and complete resale applications8 which are received by HDB from 16 December 2021 onwards.

8 A complete application is one where HDB has received both sellers’ and buyers’ portions of the resale application.

Increasing housing supply

The Government will also increase the supply of both public and private housing to meet housing demand. Details will be provided tomorrow.

The measures undertaken in this cooling package will help promote a stable and sustainable property market. The Government remains vigilant to the risk of a sustained increase in prices relative to income trends.

Issued by: Ministry of Finance, Ministry of National Development and Monetary Authority of Singapore

Blogs

We think that these articles might be of interest to you.