Sembawang Road EC GLS Site Analysis: New Northern Gem Near Canberra MRT

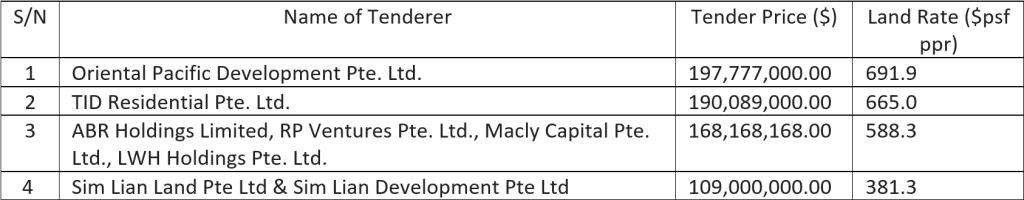

The tender for the Executive Condominium (EC) Government Land Sale (GLS) site at Sembawang Road officially closed on 11 September 2025, drawing four bids in total. The top bid came from Oriental Pacific Development Pte. Ltd., at $197.8 million, or $692 psf ppr — a price that signals cautious optimism from developers amid ongoing EC demand in the North.

Location and Connectivity

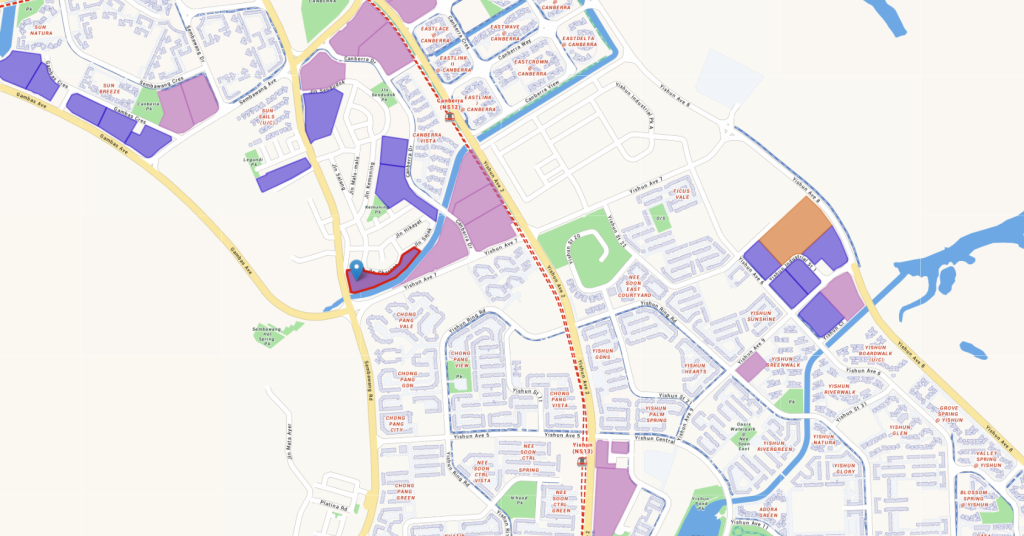

The Sembawang Road EC site is nestled within a tranquil landed enclave, offering both privacy and convenience. It’s located just a 10-minute walk from Canberra MRT Station on the North-South Line (NSL), providing residents direct access to Orchard within 35 minutes and the Central Business District (CBD) in about 45 minutes.

Connectivity is further enhanced by major roads such as Sembawang Road, Yishun Avenue 2, and Gambas Avenue, linking residents to northern, northeastern, and central parts of Singapore.

Adding to the appeal is the proximity to Woodlands Regional Centre — a growing commercial and lifestyle hub home to Causeway Point, Woodlands Civic Centre, and upcoming mixed-use developments under the URA Master Plan 2025. This will bring added vibrancy and potential capital appreciation to homes near Canberra MRT.

Price and Market Trends

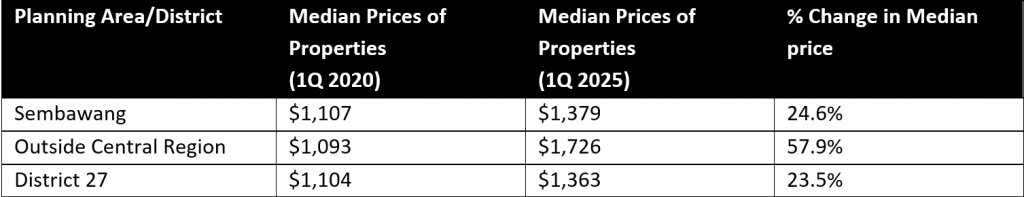

Between 1Q 2020 and 1Q 2025, median EC prices in Sembawang, District 25, and the Outside Central Region (OCR) have all shown upward trends.

While ECs in the OCR recorded steeper growth, Sembawang ECs remain attractively priced, offering value entry for homebuyers seeking affordability in the north.

This pricing gap could make the future Sembawang Road EC especially appealing to upgraders priced out of central locations — and equally attractive to developers aiming to capture the mass-market upgrader segment.

Why ECs Remain a Hot Favourite for HDB Upgraders

Executive Condominiums (ECs) continue to dominate the upgrader market for a simple reason: they offer private condo living at subsidised prices.

In 2024, the price gap between new ECs and private condos in the OCR for 900–1,000 sqft units stood at around 60% — $1.47M versus $2.36M respectively. This substantial gap underpins the EC value proposition for HDB upgraders who meet the $16,000 household income ceiling.

Additionally, EC buyers enjoy:

1. ABSD remission for Singaporeans,

2. The Deferred Payment Scheme (DPS), allowing them to pay a small deposit upfront and start the mortgage only after completion, and

3. The option to retain their existing HDB flat until receiving keys.

With these advantages, it’s little wonder ECs continue to achieve 80–90% take-up rates at launch weekends — as seen at Otto Place (Tengah) and North Gaia (Yishun).

Potential Demand and Buyer Profile

The upcoming Sembawang Road EC launch will likely draw its main pool of buyers from HDB upgraders in Sembawang, Yishun, and Woodlands.

Between 2026 and 2029, an estimated 1,300 flats in Sembawang and 8,500 units in Yishun and Woodlands will hit their Minimum Occupation Period (MOP). This wave of MOP owners represents a ready pool of upgraders seeking their next property milestone.

Nearby projects have already hinted at strong upgrader appetite. Norwood Grand, located just minutes away, has sold over 83% of its units at $2,080 psf — a clear indicator of pent-up demand for well-priced homes in the north.

Limited EC Supply Creates Stronger Competition

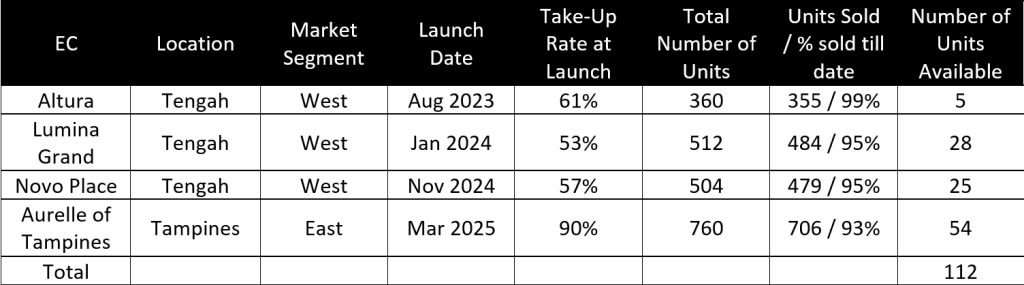

As of March 2025, fewer than 130 new EC units remain unsold across Singapore’s five active projects. While two more EC sites at Plantation Close and Jalan Loyang Besar are slated for launch, this will likely fall short of national demand.

In the north region, the EC pipeline is even thinner. The last EC launch in Woodlands was Northwave in 2016 — nearly a decade ago. The North Gaia EC in Yishun (2022) has since sold out, leaving a vacuum for new EC supply in the area.

This scarcity positions the Sembawang Road EC as a highly anticipated development, catering to both upgrader demand and family buyers seeking spacious layouts in a mature yet peaceful neighbourhood.

Affordability Challenges Still Remain

Despite healthy demand, buyer affordability remains a key consideration for developers.

With the $16,000 income ceiling, and loan limits under the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR), the maximum EC loan typically caps around $1.01 million.

Given today’s rising land and construction costs, buyers will need to fork out larger downpayments, which may influence unit mix and pricing strategies at launch. Developers are likely to focus on efficient layouts, smaller 3-bedroom units, and competitive psf pricing to align with upgrader budgets.

Site Efficiency and Tender Reflections

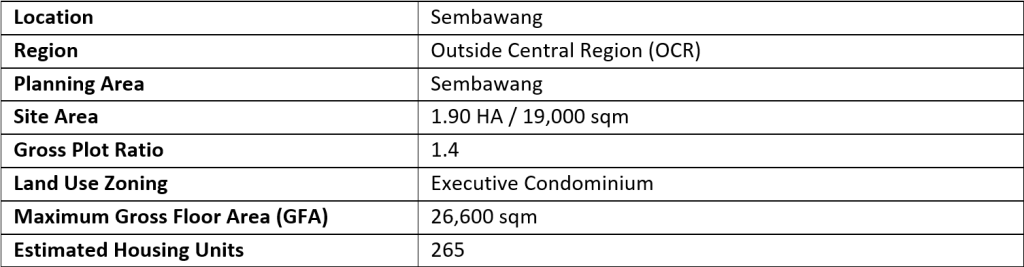

The elongated site shape and sloped terrain of the Sembawang Road parcel may pose design and construction challenges, affecting yield efficiency. The winning bid of $692 psf ppr likely factors these cost considerations in.

Nonetheless, the site’s locational advantages — including proximity to Canberra MRT, Woodlands transformation, and primary schools like Ahmad Ibrahim Primary, Yishun Primary, and Xishan Primary (within 1km for some stacks) — are expected to enhance its buyer appeal.

Assuming a standard 15-month wait-out period, the Sembawang Road EC could potentially launch in early 2027, yielding approximately 685 units. This would make it one of two EC launches in the North Region that year.

Conclusion: Northern EC Market Remains Resilient

In summary, the Sembawang Road EC GLS site underscores continued confidence in the EC market segment, where demand consistently exceeds supply.

While affordability caps will continue to challenge both developers and buyers, the strong upgrader base and limited new EC pipeline will sustain demand. For developers, this site presents an opportunity to tap into the resilient upgrader market, and for buyers, it represents a rare chance to own a new EC in the north, near Canberra MRT and Woodlands Regional Centre.

The next few years will reveal how this project positions itself — but one thing’s for sure: the north’s EC story is far from over.

Source: HDB, ERA Research and Market Intelligence

Blogs

We think that these articles might be of interest to you or perhaps you might be interested with our latest Singapore Upcoming New Launches list?