Holland Village Property Trends 2025: Where Could Singapore’s Iconic Enclave Head Next?

Holland Village property trends are once again making waves among homebuyers and investors alike. Once known as a bohemian hangout for artists and expats, the neighbourhood is now undergoing one of its biggest transformations in decades — marked by urban renewal, mixed-use developments, and a fresh residential surge that could reshape its identity.

But as familiar names fade and new towers rise, one question stands out:Where exactly is Holland Village headed from here?

A Neighbourhood That Never Stops Evolving

Holland Village’s long history of reinvention explains why today’s changes feel both inevitable and fascinating.

Back in the 1930s, it began as a small residential cluster serving British military families, surrounded by plantations and even a cemetery. When military housing expanded in the 1960s, a lively community of pubs, tailors, and bakeries emerged — setting the tone for the area’s expatriate charm.

By the 1970s, new HDB estates and the Holland Road Shopping Centre added a distinctly Singaporean flavour, bridging East and West. And when the Circle Line opened in 2011, accessibility drew yet another wave of growth.

Fast forward to today, and the Holland Village property trends show the area balancing nostalgia with reinvention — a tension that defines its current crossroads.

A Changing Commercial Landscape

Gone are many of the beloved institutions that once defined “Holland V” — Bynd Artisan, Thambi Magazine Store, and Crystal Jade La Mian Xiao Long Bao among them. Their exits symbolise a wider shift in the commercial tone of the neighbourhood.

Instead, new entrants such as One Holland Village have reshaped the streetscape since their official opening in December 2023. Developed by Far East Organisation, Sekisui House, and Sino Group, the mixed-use project combines retail, dining, offices, and residential components under one integrated identity.

Pet-friendly grocer Surrey Hills Grocer, the Mini Pitstop car showroom, and Ginkyo, a modern Japanese bistro, now define a more curated, family-friendly vibe.

These shifts suggest that Holland Village property trends are increasingly leaning toward lifestyle-driven, mixed-use integration — aligning with how newer Singaporean enclaves like Punggol Digital District and Woodleigh Hub are evolving.

The Residential Revival: One Holland Village to Skye at Holland

The resurgence of residential offerings is arguably the strongest signal of current Holland Village property trends.

One Holland Village Residences, launched in 2019 with 296 units, officially sold out by March 2025. Its success demonstrated that strong demand still exists for centrally located homes with lifestyle convenience.

Following that, the next major entry is Skye at Holland, expected to launch in 4Q 2025. This 666-unit project by a heavyweight consortium (CapitaLand Development, UOL Group, Singapore Land Group, and Kheng Leong Co.) will bring larger two- to five-bedroom layouts within a five-minute walk to Holland Village MRT.

Meanwhile, public housing has also entered the scene. The June 2024 Holland Vista BTO exercise — featuring roughly 300 units — drew robust application rates, affirming how deep the appeal of the address remains even among first-time buyers.

The pattern is clear: both private and public projects are reinforcing each other, making the area more inclusive and active than before.

Price and Rental Growth: What the Data Shows

Private Home Prices

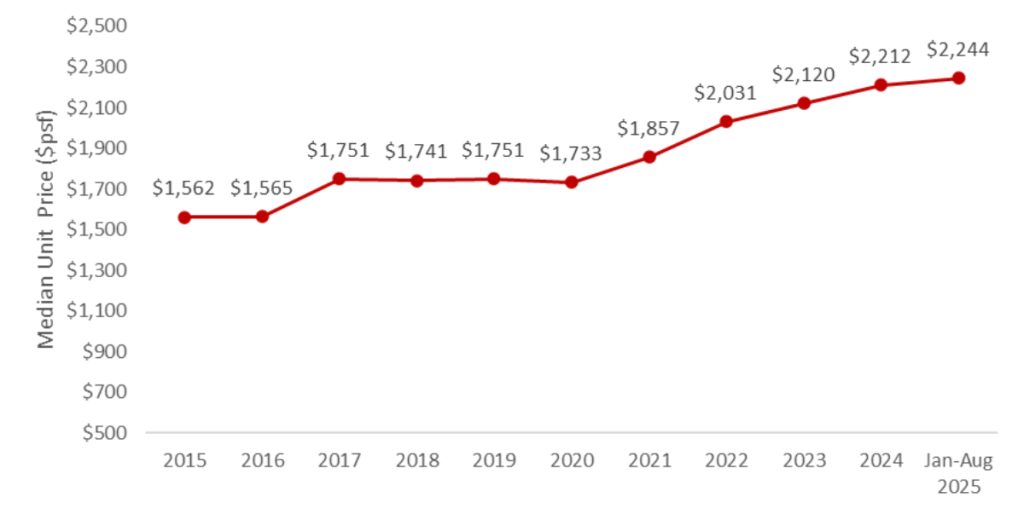

Since 2015, Holland Village property trends show sustained appreciation in both resale and new-launch segments.

Median resale non-landed prices in District 10 (which covers Holland Village) rose from $1,562 psf to $2,244 psf, an increase of 43.7 %.

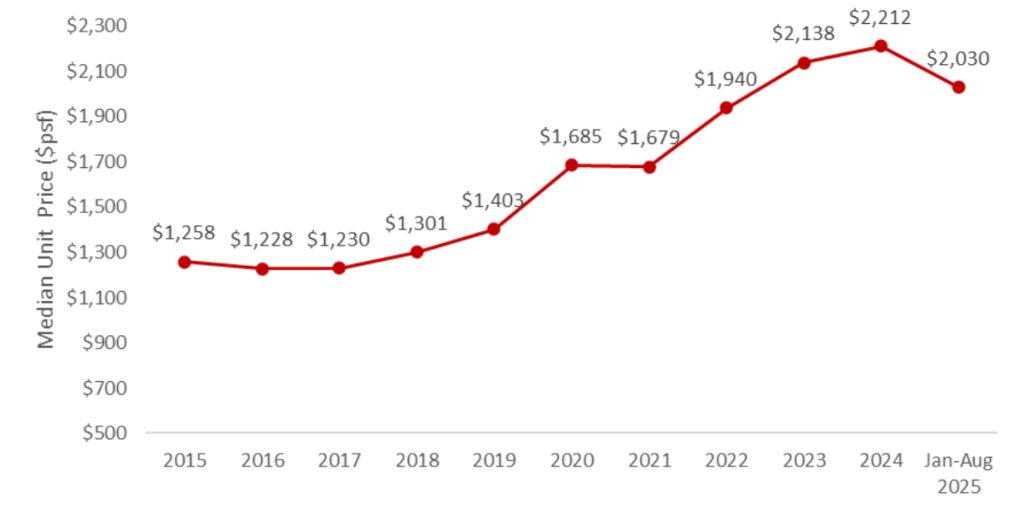

In the broader Queenstown planning area, prices jumped 78.2 %, from $1,258 psf to $2,030 psf.

This points to a long-term annualised growth of about 3 % – 4.5 %, outperforming some outer-ring districts despite market cycles.

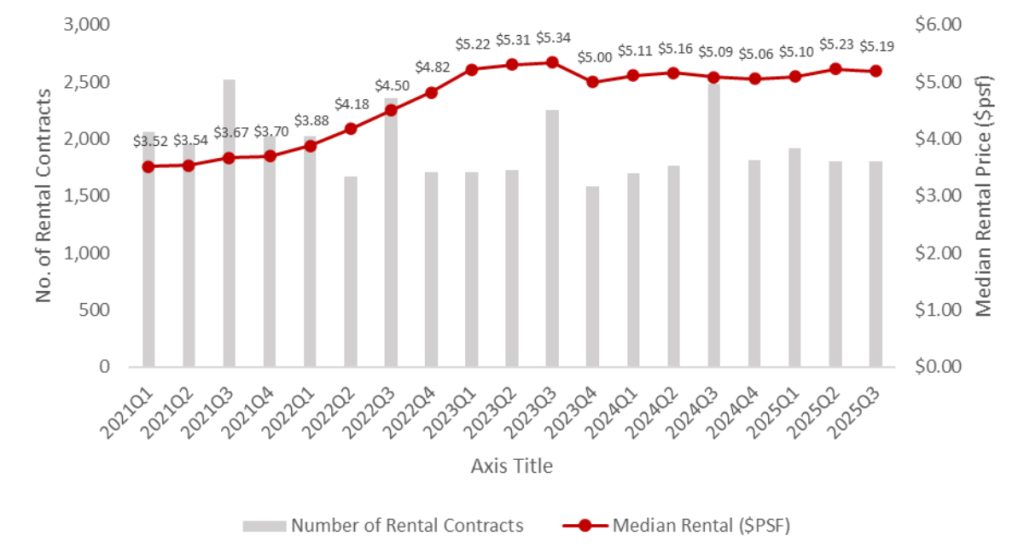

Rental Market

Rental momentum mirrors the same pattern. Median rents in District 10 climbed 47.4 %, from $3.52 psf in 2021 to $5.19 psf by 2025. Leasing volumes — between 1,700 and 2,500 contracts quarterly — suggest healthy turnover rather than speculation.

The underlying takeaway is that Holland Village property trends are resilient even amid shifting tenant profiles and evolving retail backdrops.

Why Holland Village Remains Competitive

A big part of Holland Village’s continued draw lies in location fundamentals:

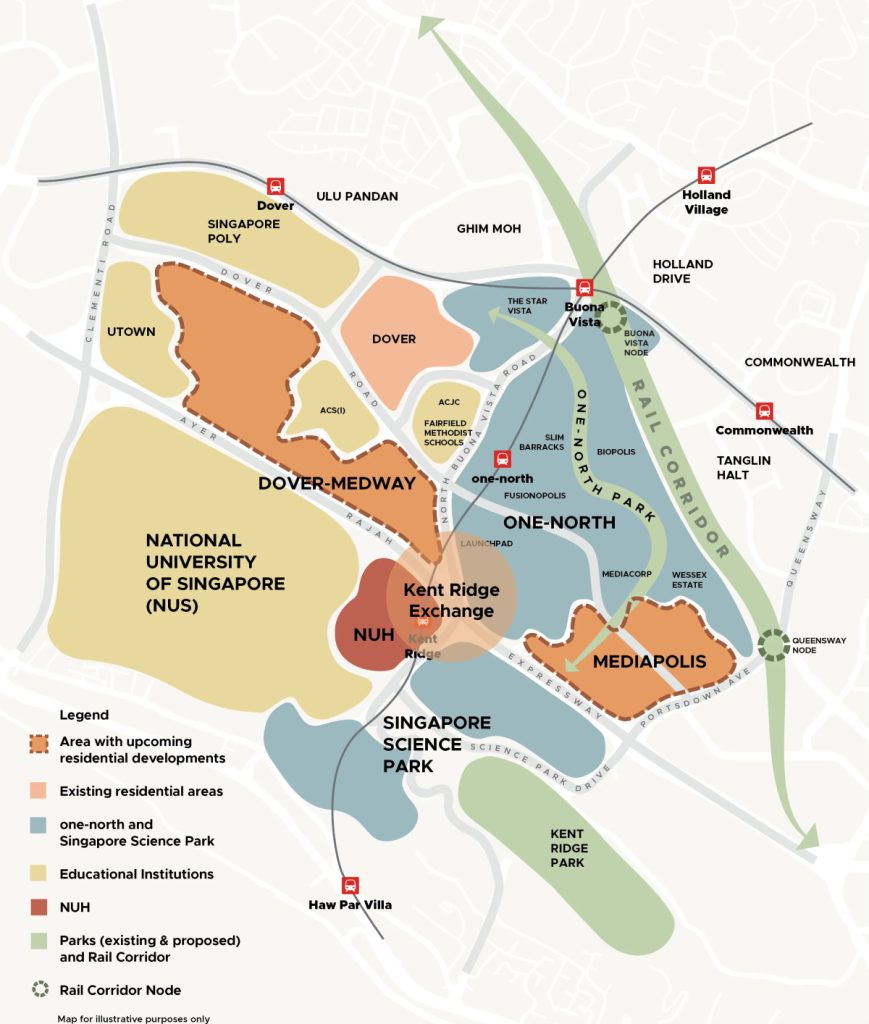

Connectivity: Direct access to the Circle Line and major roads to the CBD, Orchard, and one-north.

Prestige: Sharing District 10 with Tanglin and Bukit Timah reinforces premium perception.

Proximity to Growth Zones: one-north and Dover-Medway (both undergoing expansion under URA’s Draft Master Plan 2025) are set to bring more residents and professionals nearby.

These factors ensure that Holland Village property trends are tied to both heritage and forward-looking development, giving it a balanced investment profile.

Looking Ahead: The Next Chapter

The next wave of Holland Village property trends will likely hinge on:

New Supply: Skye at Holland and future GLS sites may redefine pricing benchmarks.

Urban Renewal: URA’s ongoing efforts in nearby one-north and Dover Medway could boost neighbourhood vibrancy.

Lifestyle Repositioning: Expect more pet-friendly, community-focused retail and F&B that appeal to hybrid-working residents.

If the past decade was about nostalgia, the next may be about relevance — maintaining Holland Village’s character while adapting to Singapore’s modern urban rhythm.

Conclusion

Holland Village property trends reveal a neighbourhood that refuses to fade quietly into the background. From steady price growth and thriving rental demand to a surge in mixed-use and residential developments, the enclave is in the midst of rewriting its own story.

Where it goes next will depend on how well new entrants preserve its charm while embracing change — a delicate balance that, if done right, could once again make Holland Village the beating heart of District 10.

Source: HDB, ERA Research and Market Intelligence

Blogs

We think that these articles might be of interest to you or perhaps you might be interested with our latest Singapore Upcoming New Launches list?