Senja Close EC GLS: Why This Bukit Panjang Site Could Be the Next Hotspot for HDB Upgraders

The Senja Close EC GLS tender officially closed on 5 August 2025, drawing healthy interest from five bidders. The highest bid came from CDL Constellation Pte. Ltd. (City Developments Limited), at $352.9 million or $771 psf ppr, showing developers’ confidence in the Bukit Panjang area’s growth potential.

Prime Location with Everyday Convenience

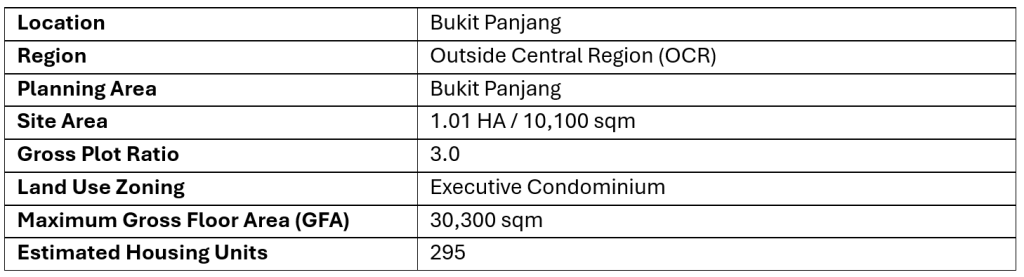

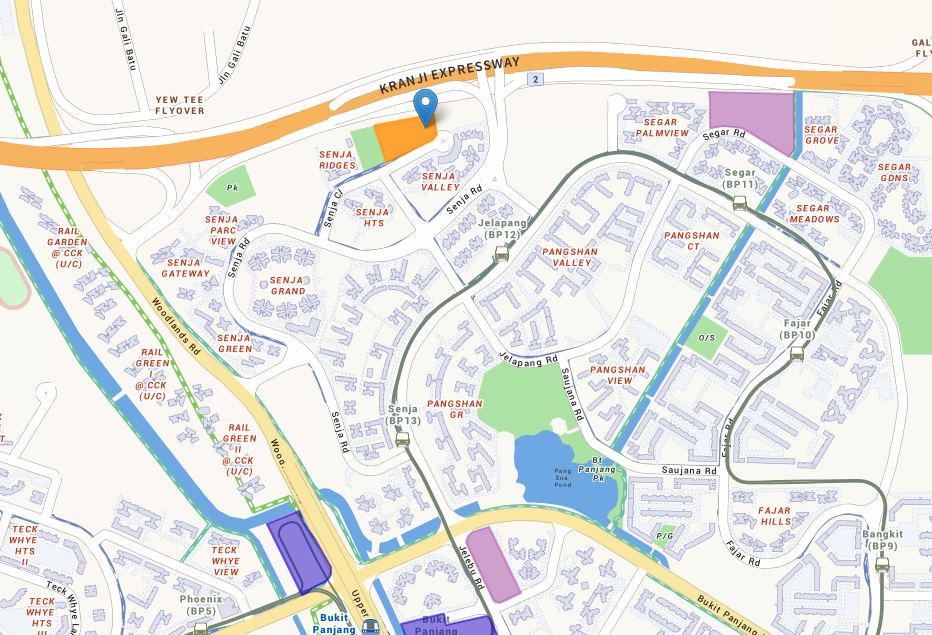

Situated just a 10-minute walk from Jelapang LRT Station, the Senja Close EC GLS site offers convenient access to Bukit Panjang MRT on the Downtown Line (DTL), linking directly to Singapore’s city centre and eastern districts. Nearby, Choa Chu Kang MRT and Bus Interchange also provide additional connectivity via the North-South Line (NSL).

Motorists will find the development well-connected through major roads such as Kranji Expressway (KJE) and Bukit Timah Expressway (BKE). Plus, Woodlands Regional Centre and Jurong Lake District, two key employment hubs, are just about 20 minutes away.

Families can look forward to strong schooling options, with three primary schools within 1km, and easy access to amenities like Senja Hawker Centre, Senja Woods Park, and Greenridge Shopping Centre — making the site attractive to both upgraders and young families.

Steady Price Growth in the Executive Condominium Market

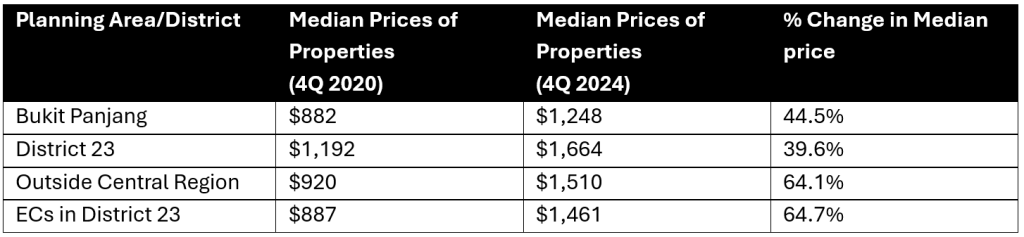

From 4Q 2020 to 4Q 2024, the Executive Condominium (EC) market has seen remarkable growth. In Bukit Panjang, median EC prices rose 44.5%, while District 23 and the Outside Central Region (OCR) recorded 64%+ gains.

This trend underscores the resilience of ECs — especially as they remain an affordable step-up option for HDB upgraders who aspire to own private property without paying the full private condo premium.

ECs Remain the Preferred Choice for HDB Upgraders

One major appeal of ECs is their pricing advantage. In 2024, new private condos in the OCR averaged around $2.1M, compared to $1.48M for similar-sized EC units — a difference of roughly 42%.

EC buyers enjoy extra perks too — no ABSD, Deferred Payment Scheme (DPS), and the flexibility to retain their existing HDB until the EC receives its Temporary Occupation Permit (TOP). This allows smoother financial planning for families upgrading from public housing.

Recent EC launches such as Otto Place (Tengah) saw over 50% take-up rates, despite the 30% quota for second-time buyers — a strong testament to ECs’ enduring appeal.

Demand Outlook for the Senja Close EC GLS Site

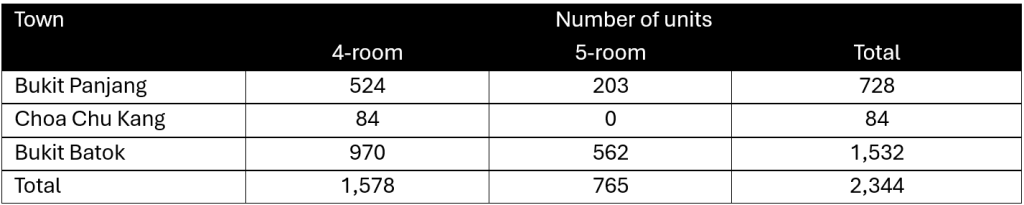

Demand for the Senja Close EC GLS site is likely to come from HDB upgraders in the western and northern regions — particularly from Bukit Panjang, Choa Chu Kang, and Bukit Batok, where an estimated 2,300+ flats will reach MOP between 2024 and 2027.

With no new ECs launched in Bukit Panjang since Blossom Residences (2011), pent-up demand could drive strong interest in this project. Moreover, proximity to LRT, MRT, schools, and amenities makes the site especially compelling for family buyers.

In 2024, 5-room flats in nearby towns averaged between $618,000 and $758,000, suggesting healthy affordability among potential upgraders.

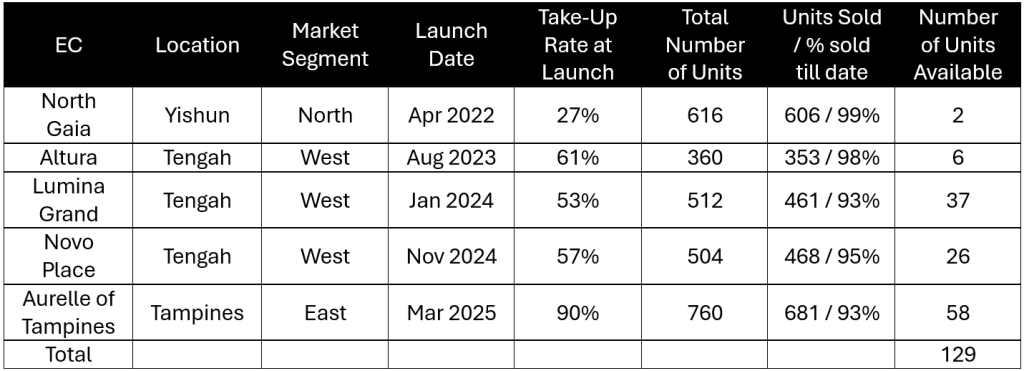

Limited EC Supply – A Key Opportunity

As of early 2025, fewer than 130 unsold EC units remain islandwide. The next two EC launches — Plantation Close and Jalan Loyang Besar — may not be enough to meet demand.

This makes Senja Close EC GLS one of the few upcoming western EC opportunities located within a mature estate. Buyers seeking an established neighbourhood with strong transport links will likely favour this development.

Buyer Affordability and Developer Strategy

Due to income caps ($16,000 household ceiling) and financing limits (MSR and TDSR), most EC buyers can borrow up to about $1.01M. Developers will therefore need to price sensitively, balancing profitability with buyers’ affordability.

Still, ECs remain less risky for developers compared to private sites, thanks to their strong local demand base and government-backed buyer pool.

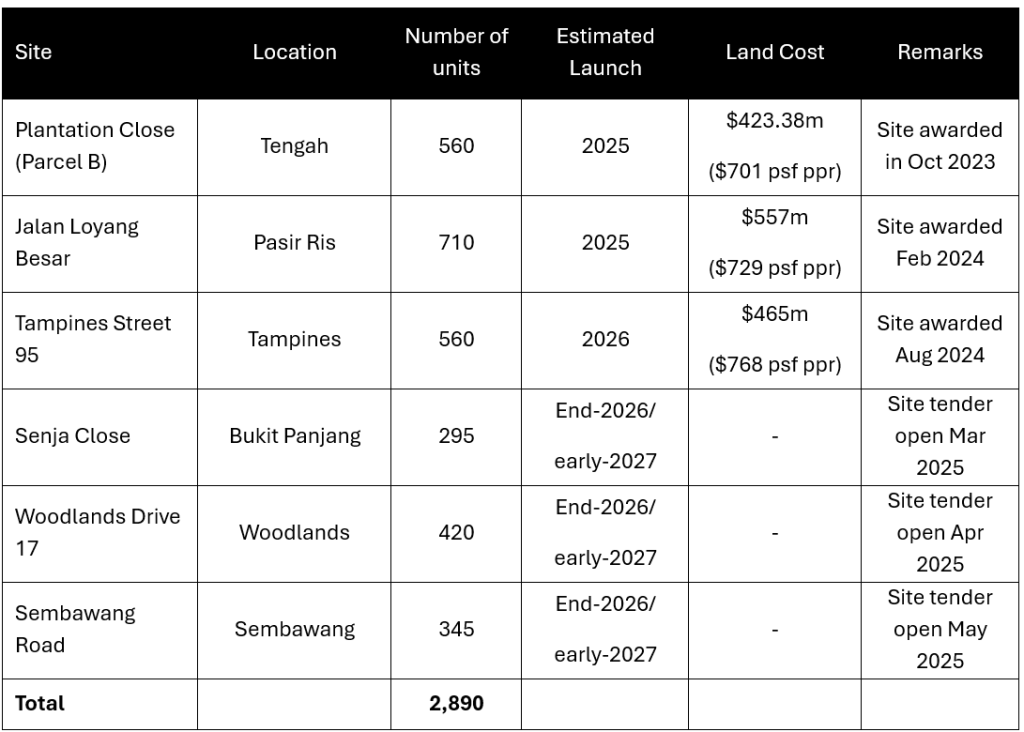

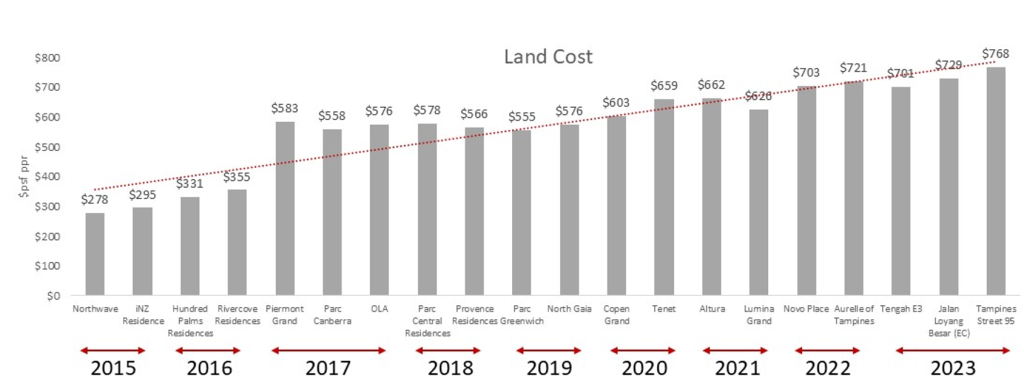

Rising EC Land Costs

EC land prices have surged 164% between 2015 and 2024, from $287 psf ppr to $733 psf ppr. The Senja Close EC GLS site continues this trend, echoing competitive bidding seen in past projects like Copen Grand, awarded at $603 psf ppr in 2021.

Given the healthy demand and rising land costs, Senja Close EC GLS could set a new benchmark price for the Bukit Panjang area.

Conclusion

The Senja Close EC GLS tender reflects growing developer confidence in the EC market. With its prime location, limited supply, and high upgrader demand, this site is poised to attract strong interest and potentially set new price records.

As the government prepares to release more EC plots at Woodlands Drive 17, Miltonia Close, and Sembawang Road, competition among developers will only intensify.

For buyers, this means one thing — Senja Close EC GLS could be the next exciting opportunity to own a home in an established estate, at today’s prices before the next wave of EC price increases.

Blogs

We think that these articles might be of interest to you or perhaps you might be interested with our latest Singapore Upcoming New Launches list?